With F.A.S.T. CFO™ Framework Included

STRATEGIC CFO PROGRAM 2026

Batch-20 starting on Jan 10, 2026

What it Takes to Become a CFO?

You’ve Got the Experience. The Credentials. The Skills.

But something’s not clicking.

You see people less qualified leapfrog ahead.

You're stuck in the same role for years.

You're doing everything right — yet the C-suite stillfeels out of reach.

Introducing

WHAT'S NEW IN BATCH - 20

Your Ultimate Executive Development Program to Guarantee a CFO Seat in

Your Career Here is what you will get when you join the Strategic CFO Program

Capstone Project

Office Hours

New Adjunct Faculty

New Curriculum

NEW UPDATED

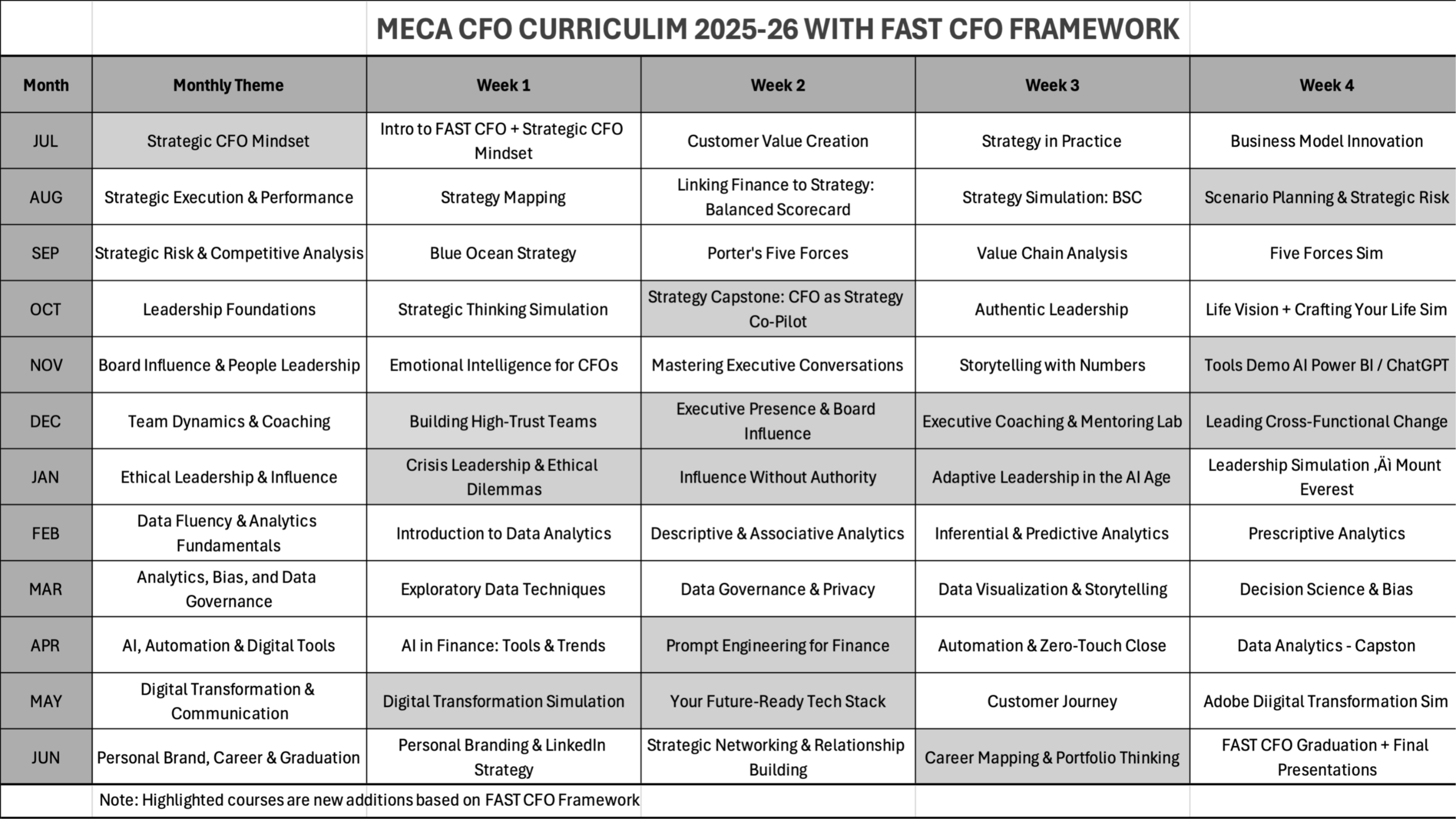

F.A.S.T. CFO BASED CURRICULUM

Curriculum 2026

Big Picture

-

Purpose: Turn accomplished finance leaders into Strategic CFOs who shape strategy, allocate capital wisely, and command the boardroom.

Format: 12 months · 48 live sessions (2 hrs/week) + labs, office hours, boardroom drills, and capstone.

Tracks: Strategy & Value Creation · Financial Stewardship & Performance · Digital & AI for Finance · Executive Presence & Boardroom Storytelling · Governance, Risk & Disclosure.

opinion: This curriculum is unapologetically practical—every topic lands in a tool, template, or decision.

Learning Arcs (What you’ll actually master)

-

Strategy & Value Creation

-

Strategy maps, Blue Ocean moves, Five Forces, growth pathways, pricing & margin architecture.

-

-

Financial Stewardship & Performance

-

FP&A excellence, driver-based planning, capital allocation, cash & working capital, performance dashboards.

-

-

Digital & AI for Finance

-

Automation, analytics, predictive signals, prompt packs for FP&A/board updates, data governance.

-

-

Executive Presence & Boardroom Storytelling

-

90-sec CFO narrative, message discipline, “3-20-3” board deck rule, investor-grade Q&A.

-

-

Governance, Risk & Disclosure

-

Materiality, control modernization, risk heatmaps, ESG data-to-narrative, audit committee readiness.

-

Year Roadmap (Quarter by Quarter)

Q1 — Foundation to Integration (Weeks 1–12)

Focus: Link strategy → KPIs → cash. Build your voice.

Topics

-

Strategy map & KPI stack (outer forces → Blue Ocean levers → BSC).

-

Driver-based forecasting; variance as story, not excuse.

-

Working capital as growth fuel; early warning indicators.

-

Executive presence fundamentals; Storytelling 101.

Signature labs -

One-Pager Mastery: message → proof → action.

-

Value Driver Workshop: map value stream; set 5 KPIs that matter.

Artifacts -

Strategy map v1, KPI cascade, one-pager executive brief.

Q2 — Capital & Growth (Weeks 13–24)

Focus: Put money where strategy is.

Topics

-

Capital allocation framework; hurdle rates & uncertainty bands.

-

Pricing & margin architecture; product/region portfolio.

-

Scenario planning; growth bets; M&A primer & integration basics.

-

AI for FP&A I: faster forecasting, variance explainer, prompt library.

Signature labs -

Investment Committee Tournament: defend 3 initiatives under constraints.

-

Earnings Call Simulation: guidance, analyst Q&A, narrative control.

Artifacts -

Capital memo (3 theses); scenario tree; earnings brief.

Q3 — Transformation & Operations (Weeks 25–36)

Focus: Make the engine efficient and digital.

Topics

-

Operating model & S&OP finance; cost-to-serve; service levels vs cost.

-

Automation quick wins; data governance; dashboard wireframes.

-

Governance & risk modernization; materiality to disclosure.

Signature labs -

War-Game Sprints: price shock, supply disruption, competitor move.

-

Dashboard Build: exec tiles, driver trees, alert thresholds.

Artifacts -

“As-is → To-be” finance playbook; risk heatmap; exec dashboard v1.

Q4 — Boardroom Mastery & Impact (Weeks 37–48)

Focus: Influence the enterprise. Ship results.

Topics

-

Investor relations & activist basics; guidance math; crisis communication.

-

CEO partnership rhythms; culture of performance; ethics & judgment.

-

AI for FP&A II: predictive signals, ops leverage, automated narratives.

Signature labs -

Boardroom Storytelling Studio II: 12-slide deck with “3-20-3” rule.

-

Capstone Sprint & Summit: live boards, feedback, awards.

Artifacts -

Board deck v3, 90-day Value Creation Office (VCO) plan, disclosure snapshot.

Harvard Case Studies

Several original Harvard Business case studies and simulations included in the curriculum of the CFO Program

Live Sessions on Weekend

All live online sessions are conducted each Saturday at 4:00 PM or 7:00 PM UAE time for about 2 hours

Peer Learning & Networking

The program is structured to provide maximum opportunities for peer learning and networking

Sessions Playback

All coaching sessions are recorded and playbacks usually available on the same day for re-watching

NASBA Approved CPE Credits

MECA CFO Academy is approved by NASBA to award 48 CPE credits for the entire 12-month program

96 Hours of Coaching & Learning

The program is loaded with a comprehensive curriculum that requires 96 hours of coaching and learning

Certificate of Completion

Upon successful completion of the program, participants will receive a Certificate of Completion from MECA

MECA Alumni Benefits

Graduates of this program can join MECA CFO Alumni, an active group of senior finance leaders from around the world

Experiential Learning through

Case Studies and Business Simulations

A Unique Feature to Learn Business by Doing Business

MECA CFO Academy is proud to introduce several Harvard case studies and business simulations as part of the curriculum of the Strategic CFO Program. Through a special arrangement, Harvard Business has allowed MECA to use its teaching material in MECA Executive Education Programs.

Business simulations are increasingly getting popular among the top business school as an e-learning tool to provide experiential learning opportunities to their students.

Never experienced business simulation or case study method before? Watch below short explainer.

What is a Business Simulation?MEET OUR FACULTY

Saleem Sufi

Saleem Sufi has been a Global Strategic CFO for more than 20 years working for world-class Fortune 500 and top Private Equity owned companies in Asia Pacific, Middle East, Europe and United States. As an experienced speaker, corporate trainer and executive coach, Saleem has conducted numerous executive level workshops and seminars at international locations including Tokyo, Singapore, Shanghai, Hong Kong, Milan, Riyadh, Dubai and New York.

Saleem is an MBA with major in Strategy and Finance and a Fellow member of the Institute of Cost & Management Accountants. He has attended Harvard Business School a number of times for Executive Education. He has coached and trained hundreds of senior corporate professionals around the globe. He is the founder of MECA CFO Academy and currently dedicated to helping Finance professionals grow in leadership roles.

Dr. Prashanth Southekal

Dr. Prashanth Southekal is the Managing Principal of DBP Institute (www.dbp-institute.com), a data and analytics consulting, research, and education firm. He is a Consultant, Author, and Professor. He has consulted for over 75 organizations including P&G, GE, Shell, Apple, and SAP. Dr. Southekal is the author of two books — “Data for Business Performance” and "Analytics Best Practices” — and writes regularly on data, analytics, and machine learning in Forbes.com, FP&A Trends, and CFO.University. ANALYTICS BEST PRACTICES is in the top 100 analytics books of all time and in May 2022 was ranked #1 by BookAuthority. Apart from his consulting pursuits, he has trained over 3,000 professionals worldwide in Data and Analytics. Dr. Southekal is also an Adjunct Professor of Data and Analytics at IE Business School (Madrid, Spain). CDO Magazine included him in the top 75 global academic data leaders of 2022. He holds a Ph.D. from ESC Lille (FR) and an MBA from Kellogg School of Management (U.S.). He lives in Calgary, Canada with his wife, two children, and a high-energy Goldendoodle dog. Outside work, he loves juggling and cricket.

Is the Strategic CFO Program for You?

The Strategic CFO Program is not just a course. It’s a transformation journey to rewire your thinking, mindset, and leadership style.

- Designed and Built by Saleem Sufi, a worldclass CFO Coach, Mentor & Advisor.

- A 600+ Alumni CFO Members Studied the Same Program. 18 Batches completed.

- An Unconventional CFO Program that is considered better than the high-priced CFO Programs offered by the Top Business Schools.

This program will transform you from a capable finance manager to a high-impact, boardroom- ready Strategic CFO.

🚨 Strategic CFO Program — Batch 19 Almost Full

MECA Strategic CFO Program vs Other Institutions

| Criteria | MECA Strategic CFO Program | Harvard Business School | Wharton Executive Education | INSEAD | London Business School |

|---|---|---|---|---|---|

| 1. Curriculum Coverage | Comprehensive, regularly updated | Extensive, broad coverage | Intensive, focused modules | Diverse, global perspective | Extensive, contemporary content |

| 2. Faculty Expertise | Experienced industry professionals | Renowned academics & experts | Leading professors & practitioners | Distinguished global faculty | Top-tier academics & industry leaders |

| 3. Practical Simulations | Harvard's Mount Everest simulation | Custom case studies & simulations | Real-world scenarios & simulations | Case-based, interactive learning | Practical simulations & exercises |

| 4. Leadership Development | Personalized coaching & mentoring | Strong emphasis on leadership | Leadership labs & assessments | Leadership development focus | Leadership workshops & coaching |

| 5. Networking Opportunities | Peer networking, industry connections | Extensive alumni network | Broad alumni & industry network | Global network, diverse cohort | Strong alumni connections |

| 6. Learning Flexibility | Online and in-person options | Primarily in-person | Flexible scheduling, online options | Blended learning approach | Flexible, various formats |

| 7. Case Studies | Real-world, interactive discussions | Extensive use of case method | Real business case studies | Comprehensive case study approach | Practical, real-world cases |

| 8. Focus on Innovation | Encourages innovative thinking | Innovation in finance | Emphasis on innovative solutions | Encourages creativity & innovation | Integrates latest industry trends |

| 9. Global Perspective | International focus, diverse cohort | Global business perspective | International focus, diverse cohort | Global emphasis, international cohort | Global perspective, diverse participants |

| 10. Capstone Project | Hands-on, real business problem | Project-based assignments | Capstone project in finance | Strategic projects, real impact | Real-world capstone projects |

| 11. Program Fee | $3,000 | $40,000 | $30,000 | $35,000 | $37,000 |

| 12. Duration | 12 months | 9 months | 6 months | 10 months | 8 months |

PRICING OPTIONS

MONTHLY PLAN

ENROLL NOWONE-TIME PRICE

ENROLL NOWFREQUENTLY ASKED QUESTIONS

What is the refund policy?

How do the peer group sessions work?

What is the expected time commitment for this program?

Is course material provided?

Does the program offer Continuing Professional Development (CPD) or Continuing Professional Education (CPE) credits?

Are there any exams or assessments required to complete the program?

Are the live sessions recorded?

What is the schedule for live sessions?

What makes MECA CFO Academy’s program unique?

Can I access program materials after completion?

How can I connect with other program participants?

How do I enroll in the program?

All The Tools You Need To Build A Successful Online Business

Lorem ipsum dolor sit amet, metus at rhoncus dapibus, habitasse vitae cubilia odio sed. Mauris pellentesque eget lorem malesuada wisi nec, nullam mus. Mauris vel mauris. Orci fusce ipsum faucibus scelerisque.